If you own a business and have employees that you had to put on unemployment due to any reason related to COVID-19 you need to read this.

This is extremely important because this could save you thousands over the next few years!!

You should receive your benefit charge statements and reimbursable bills for the months of March, April, May, June and July consecutively. You will want to look over these charges and identify the employees put on unemployment due to the effects of COVID.

Under the CARES Act

Private contributor employers were told they would not be charged for COVID-19 Unemployment Claims. Meaning, you would not be charged a higher unemployment rate for furloughing employees that you could not afford due to the effects of COVID-19.

How to Protest Unemployment Charges

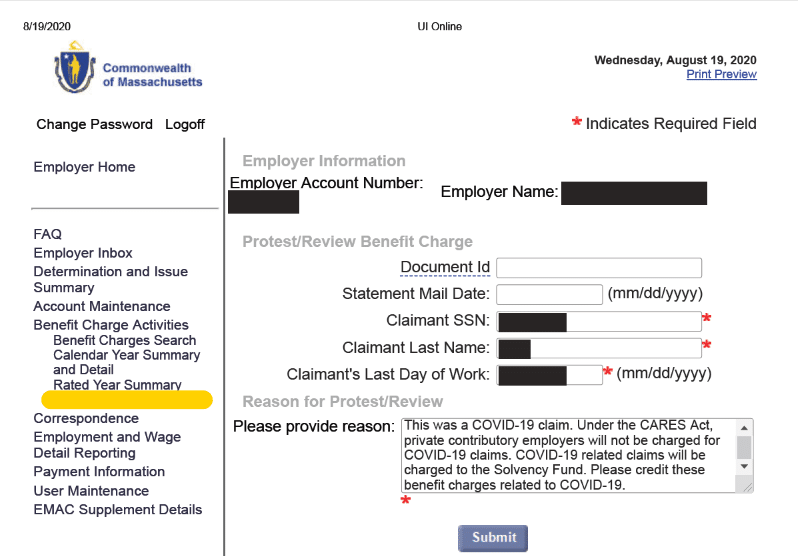

Due to COVID-19 all employers must submit their benefit charge protests through their UI Online account. If after reviewing the July Benefit Charge Statement or Reimbursable Bill, and you determine which employees were on unemployment due to COVID-19, log on to your UI Online account select Benefit Charge Activity and select Benefit Charge Protests to request a review. While completing the protest online please make sure you have the claimant’s complete name and complete SSN. Please follow the instructions below to submit a protest via UI Online:

1. Leave the document ID and statement mail date fields blank.

2. Complete all fields with a red asterisk.

3. The last day worked entered in the protest must match the last day worked on the claim. If you do not know the last day worked on the claim, please submit a request via email to EmployerCharge@detma.org with the subject line “LAST DAY WORKED INQUIRY.”

4. Enter the reason for protest in the text box.

If you do not protest these charges your unemployment tax rate can go up costing your thousands over the years. The last thing any business needs right now is higher expenses. So, if we were you we would take the above steps and protest eligible benefit charges.

This information was distributed by the Commonwealth of Massachusetts Executive Office of Labor and Workforce Development Department of Unemployment Assistance on 8/17/2020.