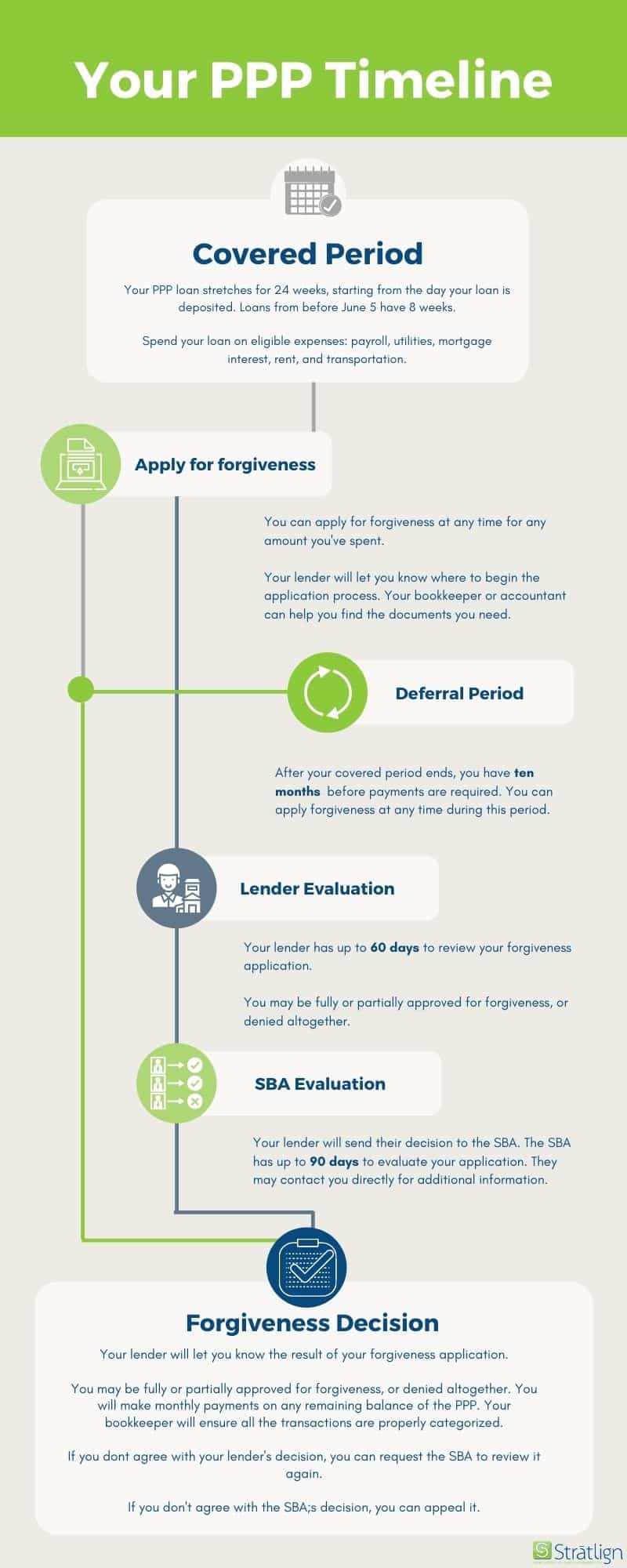

- Your forgiveness application is filed with the lender directly, not SBA

- The application can be filed after day 56 but no later than 10 months after the end of the borrower’s covered period

- All loan payments (not forgiven), including interest are deferred until the later of 10 months after the last day of your covered period; or receipt of final approval or denial of forgiveness from the SBA

- Up to the full amount of the loan plus accrued interest (through approval of forgiveness application) are eligible for forgiveness

- You cannot have forgiveness of qualified costs in excess of loan amount

- Lender must issue a decision to SBA on a loan forgiveness application no later than 60 days after receipt of a complete loan forgiveness application form from a borrower

- If lender denies forgiveness, borrower may subsequently request that the lender reconsider its application for loan forgiveness, unless SBA has determined the borrower is ineligible for a PPP loan

- SBA must issue an appropriate forgiveness amount to the lender no later than 90 days after the lender issues its decision to the SBA

- If applicable, SBA will deduct EIDL advance amounts from the forgiveness amount remitted to the lender

Apply for forgiveness now or wait?

- This is entirely up to you and if your lender is ready. So, check in with your lender first to see if they are accepting forgiveness applications.

What we are recommending:

- For any borrowers under $150,000 we are recommending holding off on applying . There is still a chance there will be blanket forgiveness for these borrowers.

- For borrowers over $150,000, we will start preparing and submitting applications after 11/10/2020. For borrowers that primarily used their funds for payroll costs.

Which PPP Forgiveness Application should you use?

- 3508S filers

- Use this form if PPP Loan amount received was $50,000 or less

- 3508EZ filers

- Use this form if one (or more) of the items below applies to you

- Self employed individual, independent contractor or sole proprietor who had no employees at the time of the PPP loan

- Did not reduce the salaries or wages of their employees by more than 25% and did not reduce the number of hours of their employees; or

- Experienced reductions in business activity as a result of health directives related to COVID-19 and did not reduce the salaries or wages of their employees by more than 25%

- 3508 filers

- Used by any borrower who cannot use Form 3508S or Form 3508EZ or who chooses to fill out the lengthier application

You can watch our full webinar covering this topic to learn more!

Rather look over our presentation slides? Fill out the form on this page and we will send it right over!