Fresh updates from the SBA on PPP Loan Forgiveness – Released 10/8/2020

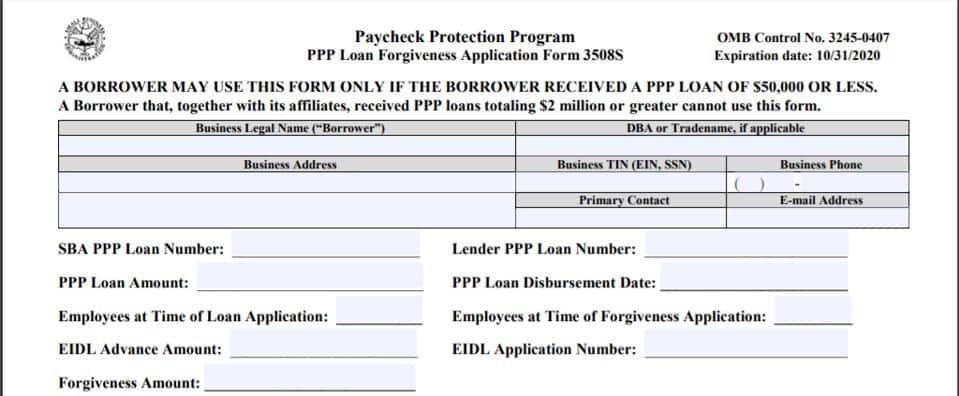

The SBA released a streamlined application — Form 3508S — designed specifically for those who borrowed less than $50,000.

2. Small borrowers (loans under 50k) are no longer required to show their math.

Although, borrower are still required to do the math and calculate the amount eligible for forgiveness.

Keep in mind too that even though you don’t have to show the math in your app the SBA has the right to request additional documents supporting your claims at any time.

Do you meet the requirements for this new 3508S Form? You can check it out here , but we suggest waiting to apply.

Why you should still wait to apply for forgiveness

We know you want to get it over with, but you may want to hold off.

It is clear the SBA is still coming out with relatively drastic changes, so holding off on submitting can still be a good idea for most people.

That doesn’t mean you can’t start to prepare your application! Fill out the form to the right and download our PPP Loan Forgiveness Checklist to get started.

For more insight register for our Webinar.

Click here to register for our webinar on October 22, 2020 at 11:00AM

- PPP Loan Forgiveness updates

- How you should go about applying for forgiveness.

- Open Q&A at the end for any unanswered questions or concerns.